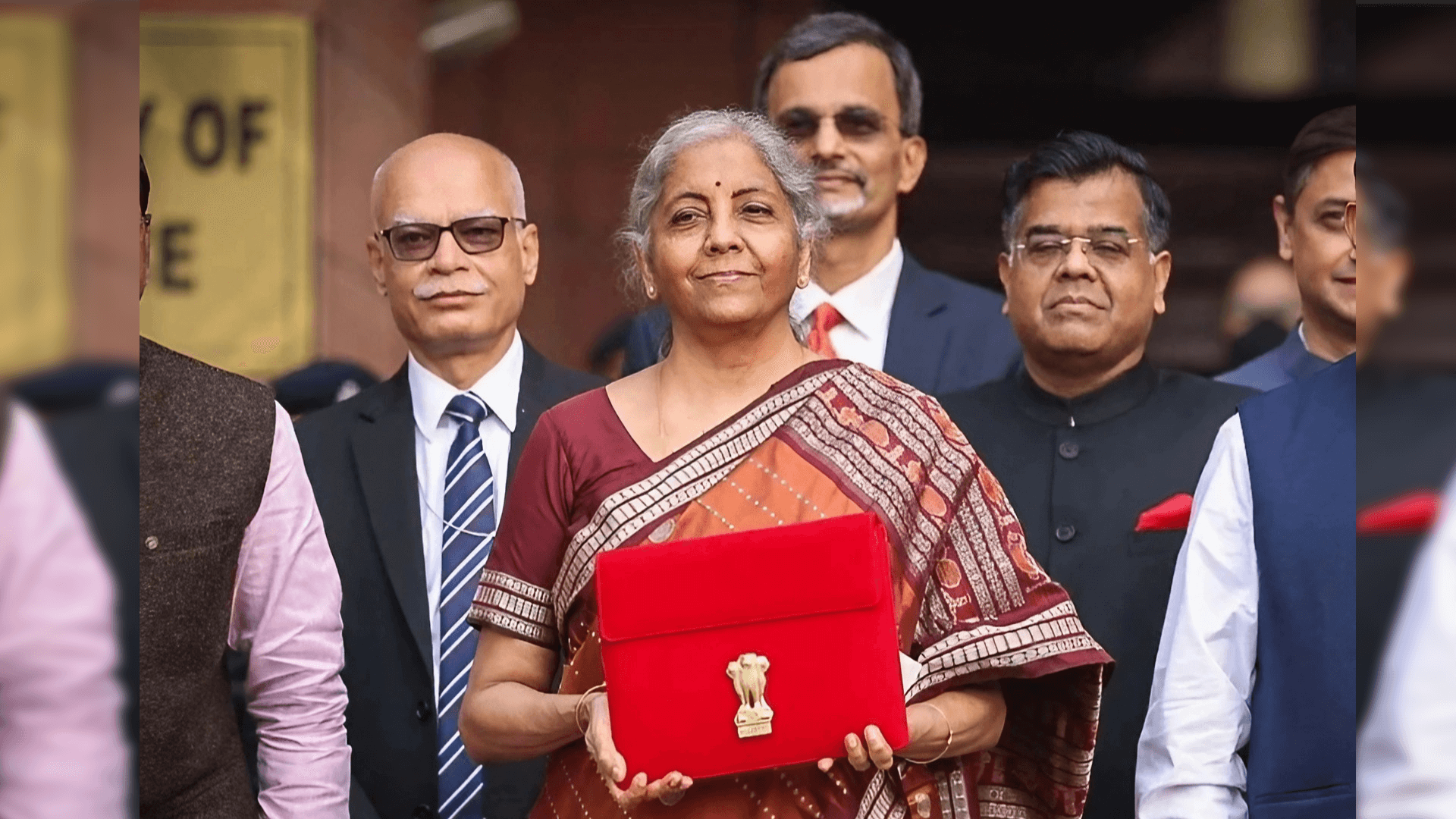

The Indian Union Budget for the year 2023-24 is presented by Finance Minister Nirmala Sitharaman on the 1st of February 2023. The budget was eagerly awaited by the people of India as it was the first budget to be presented post the COVID-19 pandemic. This year’s budget saw several key announcements and changes that are aimed at reviving the Indian economy, which has been hit hard by the pandemic. In this blog, we will take a closer look at some of the key highlights of the Indian Budget 2023.

INCOME TAX:

The Indian Budget 2023 brought several changes in the country’s tax regime. The government has announced a reduction in the personal income tax for individuals to provide relief to the common man. The government has also announced the simplification of the tax filing process, which is aimed at making it easier for individuals and businesses to file their taxes. The keynotes are:

- The new tax regime will become the default tax regime. However, the citizens can opt for the old tax regime if they want to.

- In the new tax regime, the tax on income up to 7.5 lakh has been waived off (with the inclusion of standard deduction).

- The surcharge tax has been reduced from 37% to 25% under the new tax regime.

- Under the New Tax Regimes, the new income tax slabs are like this:

- Nil: Rs 0 – 3 lakh

- 10%: Rs 6 – 9 lakh

- 15%: Rs 9- 12 lakh

- 20%: Rs 12-15 lakh

- 30%: Over 15 lakh

- Government proposes to provide for TDS and tax-ability on the net winnings at the time of withdrawal for online games, or at the end of the fiscal.

- For ease of taxpayer, a Next-Generation Common IT Return Form will be rolled out.

- In non-PAN cases, the TDS rates has been drooped from 30% to 20% on the taxable proportion of EPF withdrawal.

- For non-government salaried employees, the tax exemption on leave encashment on retirement hiked to Rs 25 lakh from Rs 3 lakh.

INDIRECT TAXES:

- The tax on cigarettes is raised to 16%.

- Custom duty on open cells of TV panels has been cut-off to 25% in order to promote TV manufacturing.

- Silver has seen a hike in import duty in order to align it with gold, and platinum.

- Basic customs duty on glycerine and crude has been reduced to 25%.

- Taxes have been reduced to 15% for new cooperatives that commence manufacturing in March 2024.

- Concessional duty on lithium-ion cells for batteries has been extended for another year, also some relief has been provided on Custom Duty on import of certain parts & inputs like camera lens.

AGRICULTURE:

One of the major highlights of this year’s budget was the focus on agriculture development. The government announced several measures aimed at doubling the income of farmers for their up-liftment, which will include:

- Developing Digital Public Infrastructure for the agriculture sector.

- Setting up of Agriculture Accelerator Fund to encourage young entrepreneurs to start more agri-startups.

- Assistance for adopting natural farming will be given to 1 crore farmers in the next 3 years.

- An Agricultural Credit of Rs 20 lakh crore will be allocated for diaries, animal husbandries, and fisheries.

- The drought-prone regions of Karnataka will be assisted by the Centre by allocating Rs 5,300 crore, for providing sustainable micro-irrigation under Upper Badra Project.

- A new scheme, GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) will be established to set up 500 new “waste to wealth” plants to promote a circular economy with a total investment of Rs 10,000 crore.

HEALTHCARE:

The Indian Budget 2023 saw a significant allocation of funds, nearly about Rs 89,155 crore for the healthcare sector for providing various services:

- Target to end sickle cell anaemia by 2047.

- Rs 3,365 crore to be allocated for the Pradhan Mantri Swasthya Suraksha Yojna for the year 2023-24.

- Rs 86,175 crore out of Rs 89,155 crore is allocated to the Department of Health and Family Welfare, while Rs 2,980 crore is given to the Department of Health Research.

- The National Digital Health Mission saw a great boost in its budget allocation – from Rs 140 crore to Rs 341.02 crore.

- For autonomous bodies, the budget is increased from Rs 10,348.17 crore in 2022-23 to Rs 17,322.55 crore in 2023-24.

- Also, for the National Tele Mental Health Programme, the budget is increased from Rs 121 crore to Rs 133.73 crore, and the budget allocation for ICMR (Indian Council of Medical Research) saw a boost from Rs 2,11.73 crore to Rs 2,359.58 crore.

EDUCATION:

The education sector was also a key focus area in this year’s budget. The government has announced several measures aimed at improving the quality of education in India. These measures include:

- New Nursing Colleges, about 157 will be established in apposition to 157 already running Medical Colleges established since 2014.

- Three centers of excellence for artificial intelligence are going to be brought up in the top educational institutes.

- To increase the growth in innovation and research by start-ups and academia, National Data Governance Policy will be brought up.

- Grant for the UCG (University Grant Commission) has been raised by Rs 459 crores.

- In the coming 3 years, Eklavaya Model Residential Schools will be set up. 38,800 teachers and support staff for 740 schools serving up to 3.5 tribal students will be recruited by the Centre Government.

DIGITAL INDIA:

The Indian Budget 2023 saw a significant focus on the ‘Digital India’ initiative. The government has announced several measures aimed at promoting digitization in the country. These measures were:

- As 5G is the big next trend in India, to develop applications to use 5G services, 100 labs will be set up in various engineering institutes across the country.

- These labs will have all the things needed to cover things like smart classrooms, precision farming, and healthcare applications.

- The scope of the services of DigiLocker will be increased.

- The big market players of the industry will partner with various government organizations to develop, and provide scalable options for health, agriculture, and other sectors.

- Phase 3 of the E-court project will be put into action with a budget of Rs 7,000 crore.

JOBS:

- 30 Skill India International Centers will be set up across the country, in order to prepare the youth with the perfect skills for international opportunities.

- Pradhan Mantri Kaushal Vikas Yojna 4.0 will be launched by the Government.

- In the coming three years, under a pan-India National Apprenticeship Promotion Scheme, Direct Fund Transfer scheme will be rolled out to provide stipend support to around 47 lakh youth of the country.

DEFENCE:

The Indian Budget 2023 brought several changes in the country’s Defence budget. It got a hike of 13%, with the allocation as follows:

- The budget was increased from Rs 5.25 lakh crore to Rs 5.94 lakh crore.

- For capital expenditures like buying new weapons, warships, aircraft, and other military hardware, Rs 1.62 lakh is allocated.

- For the Indian Army, the budget of Rs 37,241 crore is set.

- The Indian Navy has been allocated Rs 52,804 crore is given for its expenditures and for the Indian Air Force the capital outlay was the highest at Rs 57,137.09 crore.

- For DRDO (Defence Research Development Organisation), the capital budget of Rs 23.264 crore is allocated and the capital budget of BRO (Border Roads Organisation) is increased to Rs 5,000 crore

In conclusion, the Indian Budget 2023 had several key announcements and changes aimed at reviving the Indian economy and improving the standard of living of the people of India. The budget had a focus on various important sectors such as agriculture, healthcare, education, infrastructure, digital India, and tax reforms. These announcements and changes are expected to positively impact the Indian economy and the lives of the people.

This article sheds light on some of the important key elements of the Indian Union Budget 2023-24. In order to read about it in detail, refer to the below link:

https://www.indiabudget.gov.in/doc/budget_speech.pdf